A house favorite comes up, and the hardest part of investing

Not all tech was created equal

The performance of Big Tech (FAANG) has left the broader market in the dust this year. This trend might increase as slowing GDP growth and rising interest rates reduce demand for digital disruptors with poor profitability and large financing requirements. Still, these Big Tech are more and more at risk from regulators around the world who want to "break it". This is why I don´t think it is a good idea to overweight your portfolio with these companies. Instead, I am prioritizing mid-cap and (smaller) large-cap tech businesses with strong financial strength and profitability, but under the goliath businesses' radar. My rookie investor scorecard is still my favorite tool to find it.

A house favorite is back!

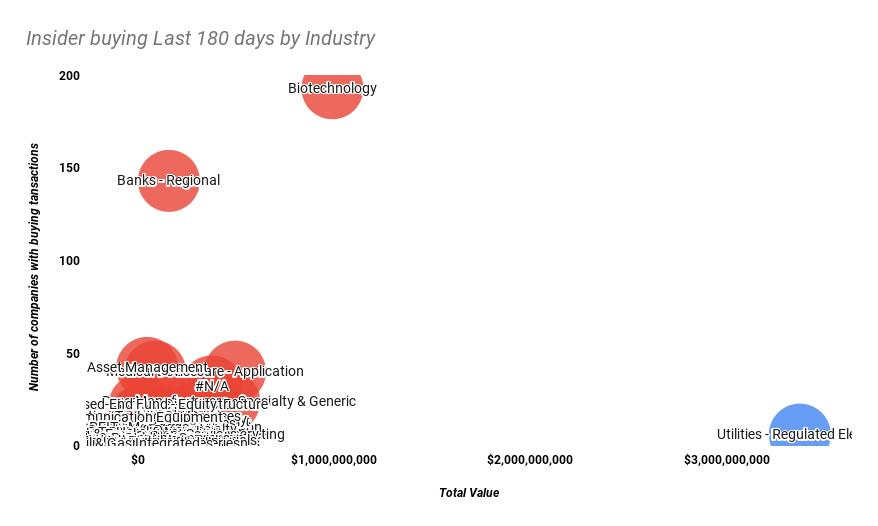

Speaking of which, here comes Jack Henry (JKHY) back in the buy zone thanks to one its director who bought shares last week. This is a 13 billion tech company that mostly serves small banks in the US, also known as "community banks". And there is a lot of that kind of bank there, most of them are already Jack Henry´s client. Sure that means growth by customer base expansion is not really a good prospect, but they provide the software for banks to get up to speed with the digital experience consumer expect. That means JKHY is small banks´ best strategic friend, now that every business on the globe has prioritized "digital transformation". Their moat is that they already have a business relationship with all these banks, and the switching cost for them is huge once they chose JKHY´s solutions to provide online or mobile banking. It is NOT a high growth stock, as its sales grow under double-digit, and I don´t see that changing, but the predictability of the business is enormous. Last but not least, a lot of insiders in the community banks sector bought this year, so they sure believe community banks are there for the long term. Valuation is fair, I am adding to my JKHY position, it won´t make you rich but brings stability to the portfolio.

Selling: the hardest part of investing yet

Investing is so much fun to me, I love learning about new things, new products, new companies or just new industries. I feel excited when I open new positions and feel part of the amazing companies changing the world. Today I had a chat with a value investor consultant from Etoro and made me think about my strategy, in particular in terms of selling. As I explained before, I won´t pretend to be a value investor exclusively, as I do think a few risky bets in a portfolio set yourself for astonishing returns over the long term (we are talking about more than 5 years). But I do have things in common with value investors: taking the long view, and buying quality businesses. I am also looking at valuation metrics to inform my opening positions, but not really to decide if I invest unless it is more of a mature and stable business without too much optionality, such as JKHY by the way.

I have to work on a more systematic exit strategy because he had a point: 70+ companies in a portfolio is just too much to track and feel really comfortable when things turn sour. I do have a lot of automation in the background to help me relax and keep track of their financials, but I still have to make a manual check at least once a year to update the context. Now, what should we do for a business like Nvidia (NVDA) which has grown +70% to a $580 billion business in the past 6 months, vs +18% for the Nasdaq? Its optionality is just endless, which makes it very hard to value. Indeed its valuation is so extreme, by almost any method you can use, that any value investor would take the gain and run. The thing is that back in October 2020, when I analyzed Nvidia, it was already overvalued, with an Enterprise Value / EBITDA of 73. But it did not stop the stock from crushing the market in the following 12 months. It is true though that it traded down for the first 6 months after my reco, losing around 20% of its market value. What did I do then? I added more Nvidia shares, but I never sold. Why should I now? EV/ EBITDA is even lower than when I first bought it.

I still have to sell

I have to reduce the number of companies I own because I cannot track it all. My aim is to reduce at 50 tickers, to begin with, so I got out of Jumia because it was just a FOMO small position anyway and never trusted it to be a quality business.

What I will do is close all the companies that have lower optionality with high valuations. On the watch will be Visa, Adobe, Innovative Industrials, Arista Networks and American Tower.

See you next week

The author of this post owns shares of NVDA, JKHY. The Rookie Investor recommends NVDA, JKHY. The Rookie Investor has a disclosure policy. This article by The Rookie Investor is not financial advice as it does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. eToro is a multi-asset platform that offers both investing in stocks and cryptoassets, as well as trading CFD assets. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Have feedback on this article? Concerned about the content? Get in touch with us directly.