Is holding a stock for 10 years really a plan?🤔

Everything started when I met with a value investor eToro consultant, Mati Alon, and he asked me, "would you buy NVIDIA today? If not, then why do you still hold it?".

It made me think because I put a lot of thought into choosing companies to invest in, not so much on when to exit it. And this has been the most challenging part of investing for me: selling businesses I love. If you read me, you notice my last few newsletters were more about closing positions than opening new ones.

I wish I sold Fastly (FSLY) before it lost 60% of its market value for sure, but of course timing is not really what I am trying to achieve here, its more about risk management. So I went and read the valuation bible, here is the part that supports the idea that holding long just because it is a fantastic company is not really a plan.

If a company beats expectations, and if the market believes the improvement is sustainable, the company's stock price goes up. But it also means managers must run even faster just to maintain the new stock price, let alone improve it further: the speed of the treadmill quickens as performance improves. So a company with low expectations of success at the beginning of a period may have an easier time outperforming the stock market simply because low expectations are easier to beat.

Another way to put it

The expectations treadmill is the dynamic behind the adage that a good company and a good investment may not be the same.

Another reason I am currently focusing on selling is that I cannot dive deep once a year in 70+ tickers; my limit is about 35. And not tracking a stock exposes me to bad decisions when things turn sour, like when the market crashes. As I wrote a month ago, I aim to reduce my tickers to 50 by year-end, and 35 in 2022.

Selling can be fun, at least educative.

I think I learned more about investing while defining which tickers to close than opening new ones. I believe it is the hardest part of investing because closing can mean have to let go of fantastic companies, but the expectations the market puts in it are too far from what you think it can achieve. You first have to get an idea of what it can achieve in the next 5 years, and then compare it with what the market expects. Both operations are imperfect and subject to interpretations.

Are you enjoying this content? If yes then please support me to keep going, by subscribing for just $10/month, and get access to a guaranteed weekly newsletter + exclusive access to our Slack workspace.

How to isolate expectations from a company valuation?

And how to do it at scale from my hundreds of tickers from my watchlist? You can use many different methods to do just that. I chose the following: compare the company current price to free cash flow ratio (aka P/FCF) to its mean P/FCF, and calculate its implied growth (aka the market expectation) with a simple formula:

Market expectation as the implicit annual growth for the next 5 years = ((stock price * (1+discount rate)^5years) / (starting FreeCashFlow * assumed terminal P/FCF))^(1/5years))-1

The formula is simple. I use cash flow instead of earnings because fundamental value creation equals cash flow creation, and young companies first have positive cash flows before having positive earnings. The hard part is to define the future P/FCF. To make this scalable and straightforward, I usually assume that P/FCF will fall back to its mean after 5 years. This, of course, has flaws, but I don't try to be exact with this technique. I intend to get a sense of the level of expectations built in the stock, nothing more.

By the way, I automated this process for the watchlist, if you would like to access it please let me know!

Let's sell some businesses.

To see this in practice, let's have a look at Repligen and Resmed.

Good company: Repligen

Repligen (RGEN) manufactures equipment used in the cultivation, purification, filtration, and formulation of biological pharmaceuticals. In short, it equips labs. It is an agnostic "pick and shovel" play for Gene therapies, vaccines, treatments and diagnosis. RGEN appeared on my "sell zone radar" as it got below the 10 points threshold on my scorecard. Why? Because it lacks skin in the game (poor corporate culture, no founder involved, less than 8% of insider's ownership) and has a lower than average return on capital (6.5%, but it has been steadily growing since 2017). It does have a strong moat in the form of patents, recurring revenues from equipment's supplies, expanding operating margins and some equipment switching costs. Now let's look at the built-in expectations.

The Rookie investor conducts this kind of scoring every day for a shortlist of 200 promising stocks. If you want to find the score for other stocks just search here.

Its price to free cash flow exploded recently to 367, way over its historical median of 116. If we assume its P/FCF falls back to 116 in 5 years (which would still be pretty high compared to the industry average of 28), it would have to grow at an annual avg rate of 36% for the next 5 years (with an 8% discount rate), quite a stretch compared to the 21% growth analysts forecast for the next 3 years. Can its P/FCF be higher than 116 in 5 years? Maybe, RGEN has much optionality as it grows both organically and by buying businesses, but it does not leave much safety margin. This is why I prefer to divest and close my RGEN position.

Fantastic company: Resmed

Resmed (RMD) did not fall into my sell zone, quite the contrary as it sums 14.5 points on my scorecard. It fits my "wonderful company" definition. Defining an exit point for such companies became more challenging, and many investors' opinions would diverge. ResMed (NYSE: RMD) is synonymous with sleep apnea therapy. The business has a stronghold on the worldwide market for CPAP machines, masks, and supplies. And, given how underdiagnosed the issue is, there is still plenty of room for the firm to grow.

RMD has also found new ways to grow. Part of it includes treating and monitoring other respiratory illnesses like COPD and asthma. Another part of it comes from Brightree, a cloud-based software firm RMD bought in 2016. Brightree not only monitors patients and maintains track of equipment and supplies; it also allows patients to be checked for sleep apnea from the comfort of their homes. ResMed has been a frontrunner in connecting home-based patients to hospital systems via Brightree. It is now Cerner and Epic Health Systems' chosen partner for home health and hospice care, two primary participants in hospitals' data systems. This positions the business well to serve the growing base of patients transitioning between hospital treatment, home care, skilled nursing facilities, and hospice. CEO Mick Farrell's aspiration that ResMed "can be the Cerner or the Epic of outside-the-hospital healthcare" has come a long way. With more patients preferring to get treatment at home whenever feasible, the potential seems to be greater than ever.

Resmed has a lot of skin in the game (strong culture, inspiring mission, founder involved), strong moat in the form of minor network effects, switching cost & customer retention, high & increasing operating margins, patents and brand. It also benefits from not-so-shameful 13% ROIC and has shown past resilience with profit for 10 years in a row. All this is impressive and makes me want to stick with Resmed for the long run, but what about the market expectations? Its P/FCF is 60, while its median is 26. If we project it to be equal to 26 in 2026, it implies it would have to grow at an average of 28% for the next 5 years. It never grew at such a rate, and analysts expect it to grow at 18% for the next 5 years. This is 50% more than what it has shown in the past 3 years, which makes sense given how many tailwinds and optionality it has. Let's assume margins and ROIC keep improving as more revenues come from their cloud-based services, and P/FCF ends up 25% higher than its median, at 33, it would still imply a 21% growth, so no safety margin. There is too much expectation; any misstep down the road would make the total investors' return tumble. Great company, a "future of healthcare" play, but I prefer to divest it until expectations cool down a bit. This may become a multi-bagger I miss on... or not. Time will tell.

Where am I reinvesting the cash from these sales?

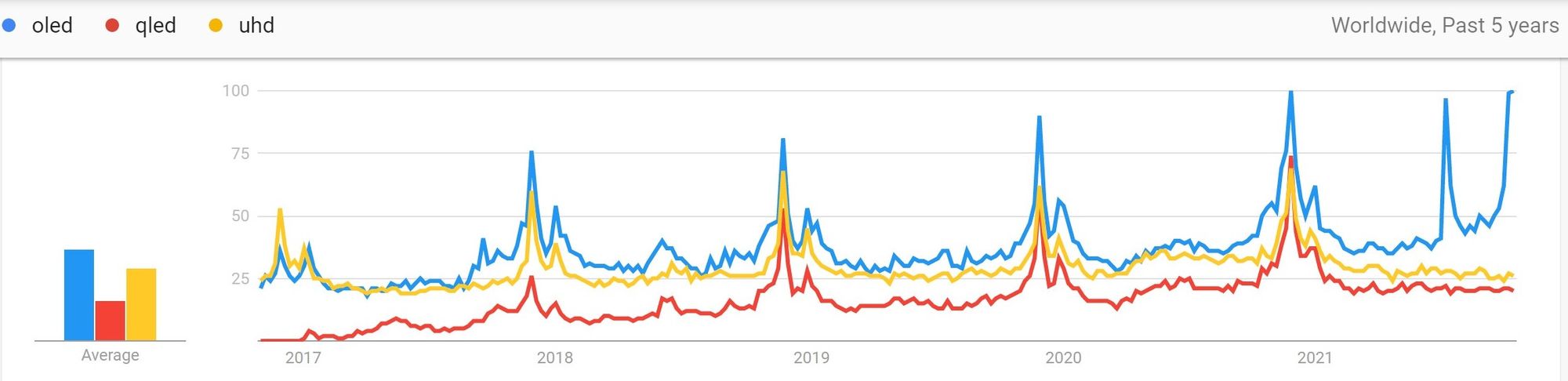

I am adding to Universal Display Corporation (OLED), because it is a fantastic company (16 points on my scorecard) and the market has low expectation from it (implied growth of 9%, while analysts forecast earnings to grow 23%). Why? Because the supply chain mess is affecting electronics shipments, hence the demand for OLED screens are projected to be delayed, at least difficult to forecast. Sure, probably, but the bears already have won on this ticker, and the stock badly underperformed, decreasing 7% in the past year. ROIC has been steadily increasing, so as margins, and demand for OLED products has never been higher.

Once the supply chain troubles stabilize, OLED will generate higher expectations. OLEDs will be around for a long time. I remain very bullish on the long-term potential, which is still in its early stages in smartphones (35 percent+ penetration), embryonic in TVs (2% penetration), and monitors (1% penetration), and has yet to commercially access additional market possibilities such as general lighting...

That´s it for today! Stay rookie, stay fresh.

The Rookie Investor has a disclosure policy. This article by The Rookie Investor is not a financial advice as it does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFD assets. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Have feedback on this article? Concerned about the content? Get in touch with us directly.