Decoding the Surprising Start of 2023: Greed is back.

The market is extremely hard to read, and bubbly as hell. I am finding peace in my "market neutral" strategy, which got my risk index to its lowest level on record (aka level 3 for eToro customers). I am not quitting it anytime soon. Here is why.

Theme 1: Inflation Trends

Keep an eye on the big picture:

- Inflation is cooling. The latest numbers show that core inflation (excluding food and energy) is rising at its slowest pace in two years. The speed of adjustment is slow, and it most analysts expect it will take about two years to bring core inflation down to the 2.X % target.

- The labor market is still hot. There are more job openings than unemployed people, and wages are rising. Not good for long term inflation.

The bottom line: don't panic. In the meantime, focus on your long-term goals, it is advisable to hold tight and not make any significant changes to your portfolio. It does seem like new inflation target are now out of the question which should greatly benefit the so called "growth stock", aka tech stocks that lose money but grow at astonishing paces.

Theme 2: Investors' Confidence and SP500 valuation.

Retail Investors are at last out of the fear territory, according to the AAII surveys, but not yet in the greed territory. What does it mean? It means don´t panic, but greed is close, and we get another couple of weeks with market gains, I would expect FOMO to win back our emotional state, we know what usually happens next. I do note that the fear and greed index built by CNN based on transactional data is already in the "extreme greed" territory. Insiders are not buying too much either.

Bottom line: contrarian thinking suggests it is still fine to invest, but at the current SP500 valuation (around 20% overvalued vs. my estimated intrinsic value), and greed nearby, market momentum could quickly switch to negative. I am adding slowly to my short QQQ position which has been trimmed by 22% because of the recent market uprising. This strategy, known as "market neutral", got my risk levels measured by eToro to its lowest level on record.

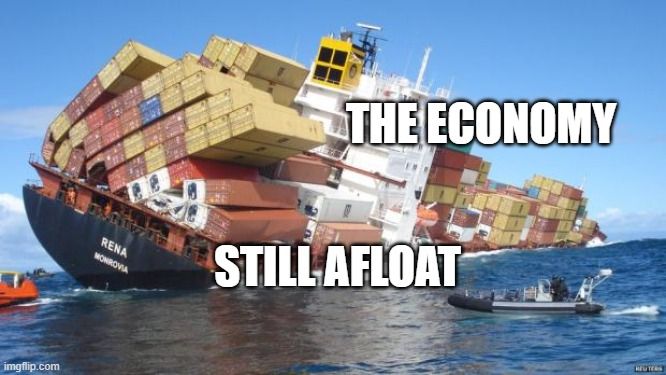

Theme 3: US Consumer Resilience

US consumer resilience is a key variable to watch, and it the consumer confidence index measured by the OECD for the US is slightly higher than the second half of 2022. So far, strong demand has allowed companies to pass through higher costs to consumers, but these benign conditions should(/may?) fade. Savings will dry up, and tighter lending conditions are worsening the outlook for consumers. A deterioration in US sales and EPS is expected. Most economists expect a recession, but Wall Street Analysts do not... volatility loooves expectation gaps.

Bottom Line: Investors should be cautious about investing in US consumer stocks in the second half of the year, and something has to give sooner or later. Make sure your portfolio is not overexposed to it.

Theme 4: Mega Forces

Mega forces are structural changes that could create big shifts in profitability across economies and sectors. These include the rise of artificial intelligence, the rewiring of globalization driven by geopolitics, and the transition to a low-carbon economy, to name a few. The key challenge here is to identify the catalysts that can supercharge them and whether all this is priced in today. For example, I think all of the AI hype is already cooked in Nvidia price, but since I sold it went up 70% so who know? I do think this checks the box of a "bubbly" market.

Bottom Line: Investors should consider investing in companies that are well-positioned to benefit from these mega forces, expect higher prices for those, but there is a limit to what you should pay. For the answer to that, do your own homework and keep in mind basic valuation methods, if you use multiples, you are using "pricing", not "value", methods.