I don´t want to grow UP... Do you?

This week I had a "career conversation" with my manager, I was asked to come up with a "personal development plan" (here is the template I use). 6 years ago, when I was new to the company, I was asked the same thing. While I was reading my old plan for inspiration, I couldn´t stop thinking "how did it change so much?".

While Benjamin Button was born old and "grew younger", I started my career 10 years ago with the highest possible responsibility and got less and less of it until now. I first founded my own business and hired people to help me, so I felt responsible for paying their salaries, even when we couldn´t... A few years later I started working at a big corporation with three times as much salary and a third of responsibilities. Today I still work at that same corporation and while I was writing my development plan, I realized I almost wanted to retire as a "junior employee".

- My employee plan 6 years ago: more or less "rule the world" in a 10 years window. "What a loser" is what would think my past self knowing where I am today...

- My employee plan now (in 2020): acquire new skills, work less, and quit/retire in a 10 years window.

Escaping the rat race

I am happy with my job, my pay, my family, and my health. My peers usually enjoy working with me, and all of my past 5 managers praised my work, so why wouldn´t I want to keep growing "up"? Because I want to do what the hell I want 10 years from now, from vacation time to where I live. "Growing up" in the corporate world usually means getting more and more responsibilities, more people to manage, and more man-hours to keep up. I would rather keep going backward, like Benjamin Button. I am now aiming at keeping slowing the pace to have more time to educate, play, and travel with my kids. This is not usually what employers expect from you. Who wants to overpay a 50-ish years old employee for working less with fewer responsibilities than a young and ambitious one? Not sure I would.

"Doing what the hell you want" takes incomes and a plan

At least in my view of "doing what I want", I need incomes. It means I have 10 years to build that income flow and quit my job. How am I going to do it?

- By saving

- By investing my savings in the Stock Market

- By building what Tim Ferris would call "a muse" (aka a side Hustle you can automate to a decent degree)

Objective: having a clear objective is key to be successful at investing, mine is to grow my monthly alternative incomes from 0 to USD 7.500 by 2030. Why 7.500? because it is more o less what I need to keep paying for my house mortgage, the kids´ education, trips, and general cost of living.

Worst case scenario: In this scenario, I suck at building a muse, and can only count on my savings and investing. Then I would plan to live on my savings dividend yields with a dividend-focused ETF (exchange-traded fund) such as VYM that yields about 3.6% annually. That means it would take roughly 2.5 million dollars of savings to get to my objective. With my current saving capacity, it means I would need to pull out an average 36% annual yield on my savings for 10 years to make it... which is not impossible but very hard.

Best case scenario: In this scenario, I manage to build a muse that produces USD 5.000 in monthly incomes, besides keeping saving and investing at my current rate. 10 years from now I would again be living on dividend yields of around 3.6%, which means I would need to have saved around 800.000 dollars to be able to complement my muse incomes to get to my objective of 7.5k incomes. At my current rate of savings, it means I would need to get an average 18% annual yield in my stock market portfolio, which is not easy but very feasible.

Final plan: giving this range of scenario outcomes, my conclusion is that I need to:

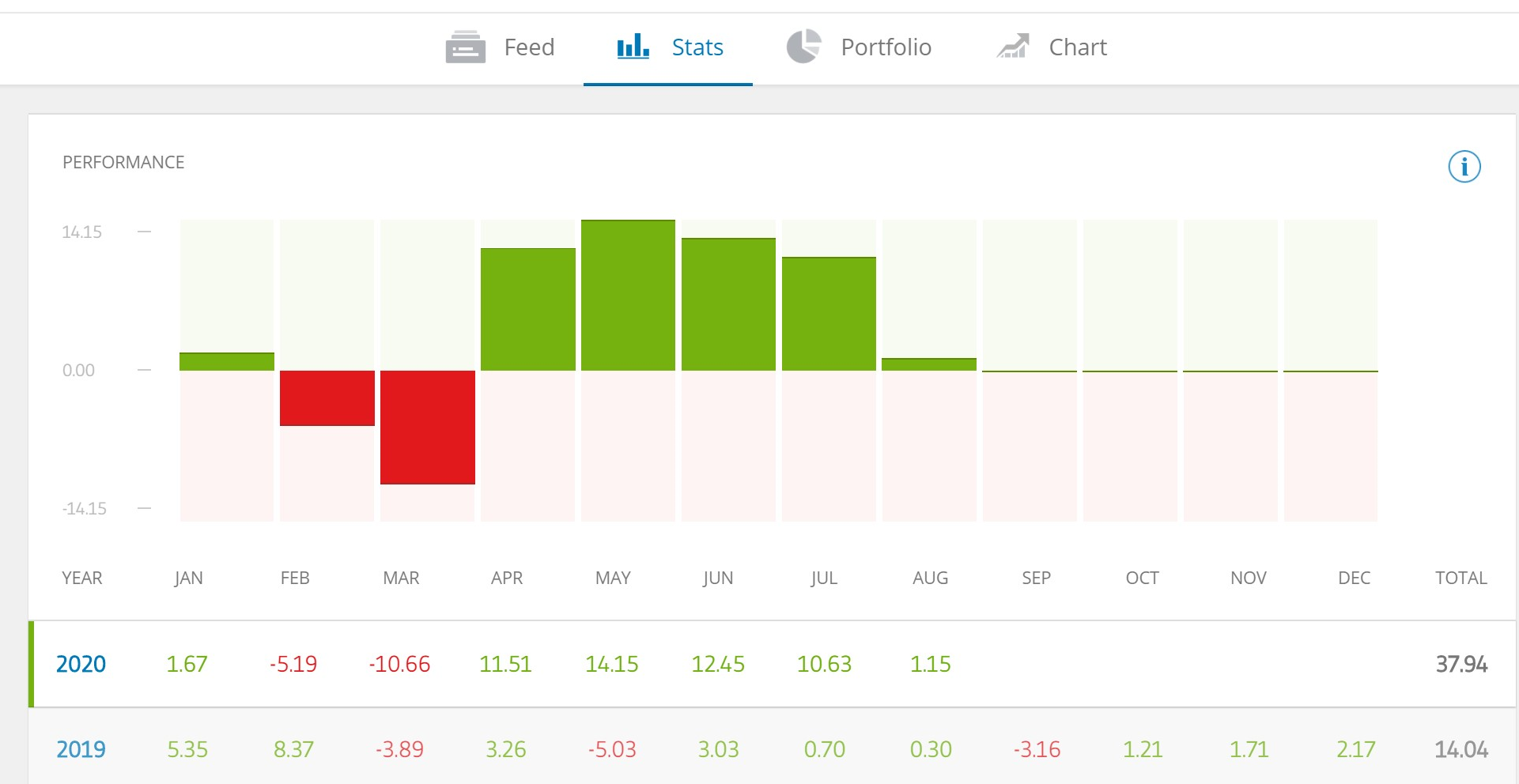

- Keep saving and investing at least 18k per year and aim for an average 25% yearly yield on my stock market portfolio with a 10 years horizon.

- Invest time to thrive at building a successful muse

- Bonus: finish paying my bachelor apartment mortgage 5 years earlier, which means lowering my daily expenses by 3% from now on, and getting an extra 700 USD of monthly income from the rent in 10 years.

This is the plan I am pursuing in the investing journey that I will share with you in this publication. I will focus on the stock market investing in my writing, but may also share some of my progress with my intent of building a muse (my current intent is related to e-commerce in the US). What´s yours?

If you want to see my live portfolio, see my stats, or even copy my trades, you will need an account with eToro, which is the broker I use. In case you do open an account with eToro, use this referral link, let me know and you win 100 USD cash. If you have an account, you can look for me by my username "Nrikike".

Happy investing! Next week I will be writing about how I research stocks and how I decide which one to buy.