Should I Buy 🐜ANT in its IPO? What else does it mean for the future of finance?

Ant Group is the biggest digital wallet, insuretech, investech and creditech company in China. It spun off from Alibaba just like Paypal did from Ebay, only that Ant handles about 25x more payment volume than Paypal😲... Yes I know this is a monster 🐜, so monster in fact that its IPO, happening in the next few weeks, will probably value it as one of the biggest Financial Institution in the world at around $300bn.

Ant business model has some big implications for the present and future of payments around the world, so I wanted to dig into it to actually answer the following question: what stocks should I own to benefit from the future of payments 💵?

A glimpse into the future of payment

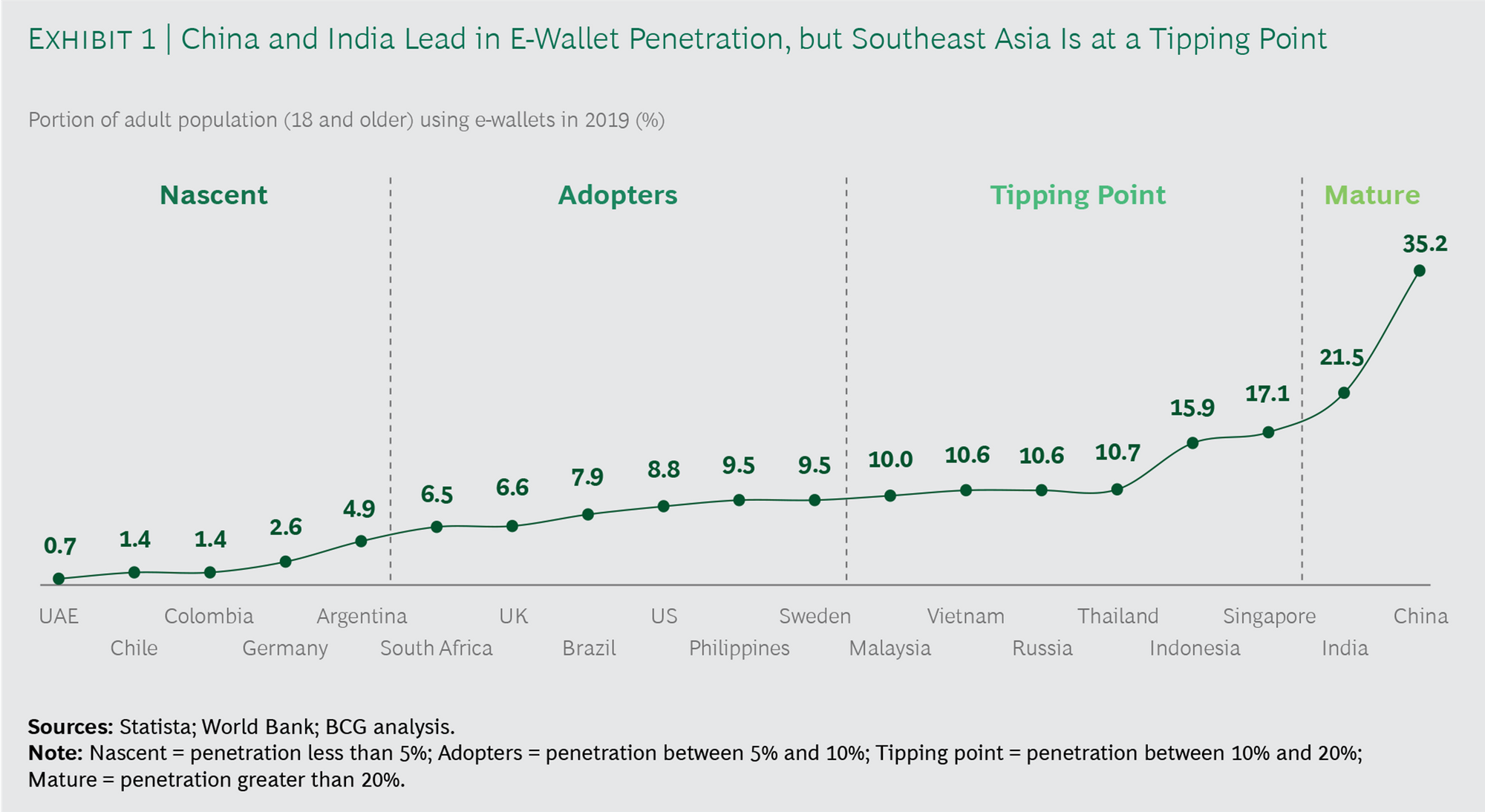

Ant gives us one version of what this future could look like, in 2017 already China was in the top 4 countries in terms of internet digital payments penetration with 85%, along with Estonia, Israel and Singapore. In terms of digital wallet penetration, China is one of the leaders, with 35% of its population using some sort of e-wallet, either Ant´s or Tencent´s for the most.

What can explain this level of adoption in China? A couple of catalysts are playing along:

- Chinese consumption was heavily reliant on cash

- Alipay jumpstarted adoptions levels in 2004 thanks to Alibaba dominant e-commerce (its mothership)

- Credit card adoption was and still remains low (even lower than South American average)

- Ant frenetic pace of user-centered innovation, such as the launch QR code for in-person payments in 2011, savings through asset management in 2013 with Yu’ebao, consumer lendings in 2014 with Huabei virtual credit card, and small business loans later on.

Who loses in this future?

Alipay was originally a payment method but, as most Fintechs around the world, it made a dent in the incumbents´ profits. Both Alipay and WeChat charge only 0,1% per transaction, far from the 1.3 to 3.4% merchants get charged in the US when using incumbents payment systems. 3 kinds of business models rely on these fees, banks´ interchange fees, payment networks´ assessment fees (such as Visa & Mastercard) and Payment Processors (most of the merchant side payment providers you can think of, from Square US to StoneCo Brazil).

Visa & Mastercard, or card networks, should be the hardest it if the Ant model scale outside of China right? Well think again, credit card transaction volume in China grew at an average annualized rate of 46% in the past 5 years, and 50% for debit cards, far beyond the world average of 14% and 20% respectively. Indeed, Debit and Credit card transactions value faired about the same amount as the total payment transaction processed by Alipay last year ($16trn). It seems the shift to non-cash transactions also impulses card transactions as most wallets are linked back to bank cards. Banking the unbanked benefit everyone in the Finance industry, both incumbents and disruptors, and the only one to lose is cash. China´s cash now only represents 17% of the total transaction value, down from 37% in 2015.

Payment Processors or facilitators, the ones who work with merchants, should also see a boost in their service business model. This kind of business used to be infrastructure businesses, to make sure payment was accepted smoothly at the point of sale and all the connections with other pipes worked correctly in the background. But it has been mostly commoditized and they now need to provide value-added services to their customers (merchants) to differentiate. Most of these services are related to their ability to leverage data to help their partners, to enable multi-channel vision, to offer niche-specific solutions, smart terminal etc. These kinds of services should not be affected by the future of payment, on the contrary, it should benefit from it as less cash-intensive transactions generate more data for them to leverage. Plus, the scenario where there is only one dominant e-wallet is the less likely outcome outside of China, and It does not make any sense for a merchant to manage a many QR codes as there are e-wallets. Indeed, new Fintechs were born to help merchants provide a sole interoperable QR code and accept payments from multiple e-wallets. So there will be plenty of opportunities of value-added services for payment processors.

Banks´ main consumer business is about fees and interest rates. In the future of finance, they have to share their already tight margin, as interest rates keep decreasing, with Financial services platforms such as Ant. So why do they accept to work with such platforms in the first place? They lose margins, they lose control over customer interactions, and they get commoditized. The reason is simple: access. They have no means to access all of these newly banked customers as Ant does, and they do not have the data nor the skills to credit score them as successfully as Ant does. So Ant actually expands the Banks business with incremental loans they would not have been able to sell without Ant. In fact, Ant only accounts for 15% of China’s consumer-lending market share. Now, Ant has done so in only 5 years, so if it keeps growing like this it will probably start canibalizing banks´ consumer lending business and it will stop being incremental for banks. On the fees side, the impact should be positive for merchant (P2M) fees as banks will trade lower fees for higher transaction volume, same for card networks, but the story is different for peer to peer (P2P) payments fees. Some countries like Europe already have regulated P2P payment for it to be free, but other countries, such as Brazil for example, still charge hefty fees for such payments, disguised in bundled monthly fees. One of the clear things about the future of finance is that domestic P2P payments will be free in just about every country. Banks in countries where such payments are not free will be impacted. HSBC analysts estimate that Brazilian banks will give up about 5% of their profit in the short term because of the lost revenue that comes from P2P payments.

So, if the future of finance looks like financial platforms oligopolies, the biggest loser is cash and, in the long terms, I think banks too.

China platforms oligopolies is not a probable scenario out of China, because of the complex and different regulations each country has, and the overprotective regulators can be toward banks. Whereas in China regulators mostly let Ant alone until now. The model central banks around the world are pushing for is much more plausible as it has the regulators backing by definition. Lets take the example of India.

The Disruptor disrupted - alternative future

We have been seeing more and more central banks facilitating national digital and free interbank payment services. India was one of the first to do so with the launch of the UPI (Unified Payment Interface) back in 2016, which requires a bank account to work. UPI creates a virtual ID for Indians, and makes inter-operability possible, so as any UPI user can connect multiple bank accounts within one mobile app. It took almost two years to build use cases for UPI, and now, after four years, a third of the total digital retail transactions pass through UPI. Bank account penetration in India was already high, not far away from the OECD levels, plus credit and debit card penetration was low, so the space was meant for disruption. What´s interesting though is that the UPI system actually disrupted the disruptors: e-wallets. E-wallets started appearing in India in 2010, way before UPI, and came to represent about 22% of all digital retail transaction volume in 2017. Now, e-wallets only represent 10%. Why UPI system displaced e-wallets? Because:

- There is no need to store money within, unlike e-wallets;

- There is no additional know your client (KYC) requirements and the security is high but simple with a one-step PIN identification process;

- It is interoperable between banks, e-wallets, merchants etc. unlike e-wallets;

- The merchants´ fees are lower than e-wallets´.

What did the e-wallets do? They diversified away from payments, copying Ant model of financial marketplaces. PayTM, the second biggest one, has recently expanded into financial services, investing, ticketing, insurance and even retail, making it sound like a super-app push. But PayTM has a small market share compared to Ant, it has to compete with banks integrated to UPI, Amazon Pay, Google Pay, Whatsapp Pay, Mobikwik and BharatPe, to name the biggest. As a consequence, the volume of data it can leverage is much smaller too, their risk model less accurate, and their margin is probably smaller than Ant´s.

How did UPI impact banks and card networks? UPI, if anything, has made the adoption of digital payments faster and easier. UPI is bringing part of the cash economy into the digital economy. Merchants that were not offering digital payment solutions (taking debit/credit cards) because of high fees are now offering digital payments through UPI (low or nil fees). Customers are also using UPI to pay loan installments, which reduces the collection costs for banks to some extent. Very similar to what Alipay has done to the whole ecosystem in China, Credit and Debit Card transaction growth accelerated well above the world average in the past 5 years. Unlike Ant model tough, banks maintain control over the customer interaction directly through their app, or through Google Pay app (Google said it had no intentions to make a business out of it, it prefers using it to leverage their Google Cloud pitch to banks). P2P fees did go away but they were low in the first place, so it didn´t impact banks that much.

UPI kinds of models have been, or are being launched, all around the world:

- Launched and tipped: NPP in Australia, FPS in the UK, Swich in Sweden, DuitNow in Malaysia, FAST in Singapore and more...

- Launched but not tipped: CoDi in Mexico

- To be launched: PIX in Brazil

Europe has started to seriously look at it, and the US will probably do the same, as the COVID paycheck experience proved them they lack a modern national payment infrastructure.

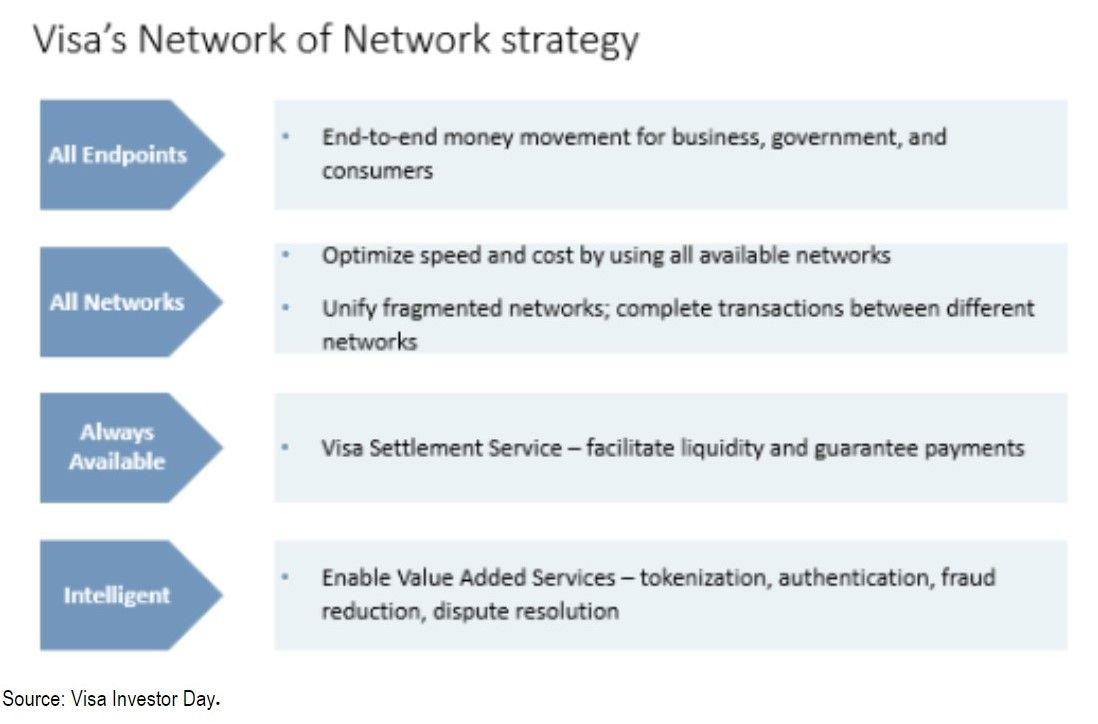

So my bet is that the UPI experience will be the closest one to the future of Finance outside of China. Plus, some central banks are talking about interconnecting such domestic systems between one another to make cross border payments seamless, and cheaper. That would be a huge blow to Visa and Mastercard, but it is still a very long shot. What is a shorter term reality is the trend of seeing more and more regulators capping merchant fees for card transactions. Europe did it in 2015, but it did not have a huge impact on Visa nor Mastercard whose stocks are +150% and +230% since then. What is interesting to see, despite how bad it looks for card networks, VISA is actually embracing such a future with its strategy of becoming "the network of network".

Both Visa and Mastercard estimate what they call "the new payment flow opportunity" at around $200T, and are partnering with application providers and beefing up their respective value-added services offerings. Where the two companies differ most, is in their real-time payment (RTP) network strategy, where Mastercard has been more aggressive in acquiring alternative networks, whereas Visa’s strategy involves leveraging (and connecting) public RTP systems, while focusing on value-added services. In 2019, Visa Direct, Visa´s own RTB platform, had 130M active users and facilitated 2B transactions across 250 programs. The quarterly run rate in 4Q19 reached $68B, up from $11B in 4Q16. Use cases include P2P, gig worker payouts, marketplaces, insurance, payroll/wage access and remittances, the opportunity is vast.

On the multiplication of new players in the payment ecosystem

These new levels of interoperability are leveling the field for new players such as Telcos and Retailers to enter the payment game. We are seeing these industries all over the world entering or going deeper into the payment offering, from T-Mobile in the US to Airtel in India. There are 2 main ways this is happening: by getting a payment bank license or by partnering with a bank. But not all countries make it possible for non-banks to ask for such licenses, so partnering is preferred in most cases. Telcos and retails take this as a loyalty platform and do not see it necessarily as a new revenue stream, which makes the partnering model the most logical one. This means a whole new business model and revenue for banks, known as "Bank-as-a-service". T-Mobile for example partnered with BankMobile to launch their checking account while Rappi partnered with Banorte in Mexico and Davivienda in Colombia to power their RappiPay service. This new business models mostly benefit banks and card networks, as most of these services are based on either a Visa or Mastercard debit card.

The sum is greater than the parts

The more I get into the world of payment the more complex it gets, apologies for the long post, but let me try to summarize it all. It all starts with the cashless trend, less use of cash means ↗ financial inclusion, ↗ deposits, ↗ savings, ↗ assets to invest, ↗digital transactions, ↗ data to leverage, ↗optionality for the industry, ↗ credit scoring accuracy, ↗volume, ↗cross selling, ↗ transparency, ↗ revenues for the whole sector ... breathe😩.... add to these positive trends the fact that it also means ↘ default, ↘branches, ↘ cost, ↘ manual processes. A LOT of positives for every player involved, banks, card networks, payment processors, e-wallets, and fintechs. On the flip side, I see the following negatives: ↘interests from credits, ↘ merchant fees commissions %, ↘ business travel, ↘ credit card rewards & incentives to use it, ↗ competition, ↘ pricing power, ↘ margin. Keep in mind that around 70% of all transactions in the world are still in cash, so I think the tailwinds and opportunities are greater than the headwinds. What is most certain is that profit from the whole sector will shift and spread among a greater number of players.

My bet is that the biggest winners will be the ones who can build the greatest moat in the form of network effects and proprietary accurate state-of-the-art "customer genome 🧬" profiles. So let´s trim our candidates.

Step 1: who are the players with a critical mass of users and data? Ant, Tencent, VISA, Mastercard, Chase, Bank of America, MercadoLibre, CAIXA Bank, ICICI Bank, Facebook, Amazon, Uber, Grab (partly owned by Softbank), GoJek (partly owned by Tencent, Google, Visa, Facebook and Paypal), Rappi (partly owned by Softbank), SEA limited, Samsung Pay, Google Pay, Apple Pay, Banco do Brasil, Capital One, Nubank (partly owned by Tencent), Paypal/Venmo, Square, Itau, PayPay (Partly owned by Softbank), Stripe (not public), Walmart (who owns FlipKart and PhonePe), PayTM (partly owned by Ant), JIO, Sberbank, State Bank of India, according to Apptopia.

Step 2: which ones have cross border scale for data leverage and diversification of regulatory risk? VISA, Mastercard, MercadoLibre, Facebook, Amazon, Uber, Grab (partly owned by Softbank), GoJek (partly owned by Tencent, Google, Visa, Facebook and Paypal), Rappi (partly owned by Softbank), SEA limited, Samsung Pay, Google Pay, Apple Pay, Paypal/Venmo, Square, Itau, Stripe (not public).

Step 3: which ones have an outstanding culture & management? VISA, Mastercard, MercadoLibre, Facebook, Amazon, Uber, GoJek (partly owned by Tencent, Google, Visa, Facebook and Paypal), Google Pay, Apple Pay, Paypal/Venmo, Square, Itau, Stripe (not public), according to Glassdoor.

Step 4: which ones have a low ESG risk 🧨? Particularly important when so much regulatory hurdle is at play. That would be VISA, Mastercard, Paypal/Venmo according to Sustainalytics scale.

My ideal portfolio for the future of Finance

If I had to choose one bet for the future of finance it would probably be one of these three: Paypal, Visa or Mastercard for all the reasons mentioned above. But I think it is too risky to bet only on US based players giving the geopolitical risk of an escalation of the Tech/Data war between countries. Even the European Union talks about being less dependent on US controlled card networks.

So here is my ideal portfolio to get exposure to the future of Finance, which I intend to build over time depending on momentums and possible dips as they arise.

- 50% on Visa and/or Mastercard + Paypal for Global scale.

- 25% on Ant and Tencent to get a piece of China.

- 10% on Mercadolibre for greater exposure to LATAM

- 5% on Itau for greater exposure to Brazil

- PayTM and PhonePE are my favorite plays to get greater exposure to India, but they are not Public. The way to get into PayTM is through Ant, while PhonePE is through Walmart. Giving the fact that the Indian Government is clearly leaning towards a US friendship and conflict with China, Walmart is my favorite. 5% on Walmart. I would love to bet on an Indian Bank such as ICICI but my broker does not have any.

- Gojek is my favorite play for South East Asia, but it is not public, and no public company seems to have more than 7% ownership in it. So my bet is on SEA Limited, which owns Shoppee and SeaMoney, and is kind of the MercadoLibre of South East Asia, with about 40 Million users just in Indonesia. SEA 5%.

That's it gang, keep in mind every piece of the future of finance go through datacenters and cloud services, don't forget to subscribe if you would like to read about that as I will probably make a similar analysis in the next few weeks.

Post Failed Ant IPO update

So as you probably know, the ANT IPO did not happen as I am writting this in December 2020. The Chinese Government put a brake on it and has asked Ant to "focus on its payment business", restraining big time the evolution of the digital wallet business model in China. So I am updating my ideal portfolio to the following:

- 55% on Visa and/or Mastercard + Paypal for Global scale.

- 15% on Mercadolibre for greater exposure to LATAM.

- 10% on SEA Limited

- 5% on Itau for greater exposure to Brazil.

- 5% on Ant and Tencent to get a piece of China.

- 5% on Walmart.

- New Addition: 5% on Jumia, the Amazon of Nigeria.

If you want to see my live portfolio, see my stats, or even copy my trades, you will need an account with eToro, which is the broker I use. In case you wonder how to invest in all these companies, I do it through Etoro. In case you do open an account with eToro, use this referral link, let me know and you win 100 USD cash. If you have an account, you can look for me by my username "Nrikike".

Don´t forget to subscribe for free and follow me on Twitter.

The author of this post owns shares of MercadoLibre, Sea Limited, Paypal, Tencent, Walmart. The Rookie Investor recommends these stocks. The Rookie Investor has a disclosure policy.