Deep into the widest-moat player in e-commerce: is Shopify a buy?

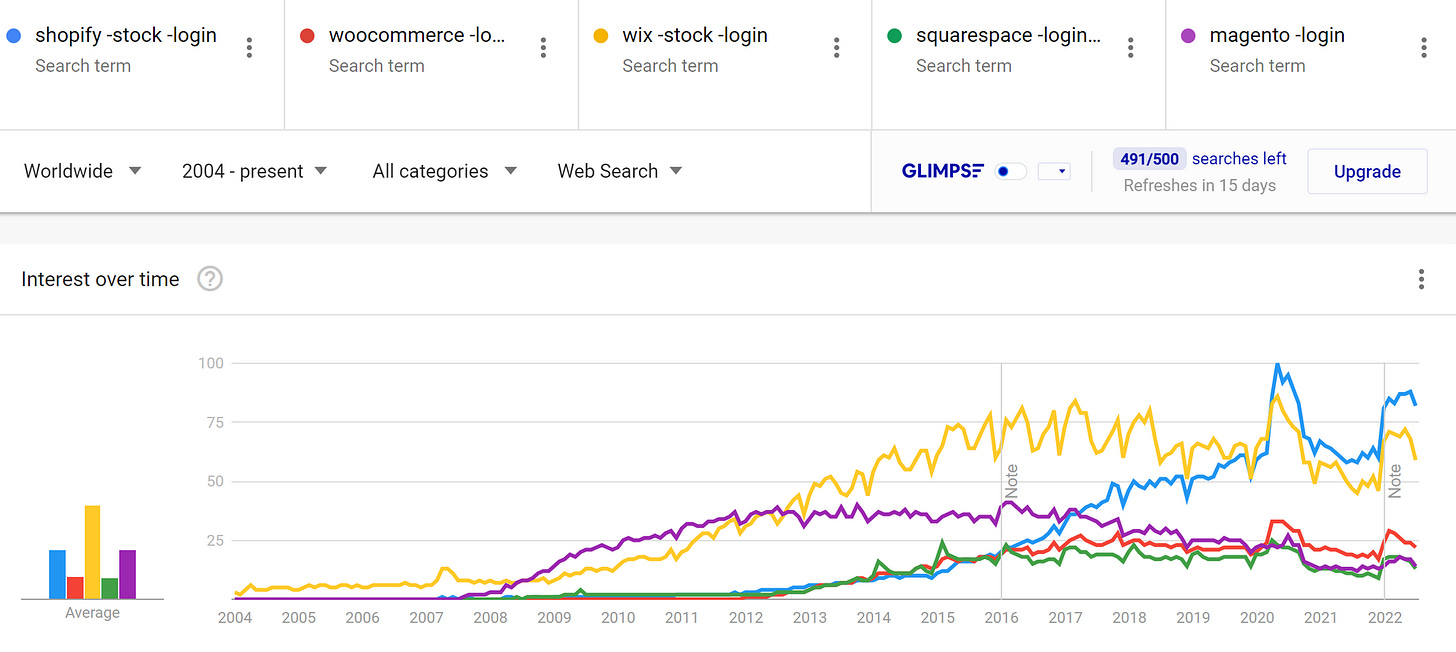

Have you heard of Mr. Beast? If not, you may want to YouTube it (spoiler: he made a real-life "Squid Game"). I spend an unexplainably long time watching his videos each time I do and feel dumber afterward. Well, Mr. Beast is one of the biggest YouTube channels worldwide. He cashes in with his massive audience by selling them "Merch" through branded e-commerce. Guess who he chose to build it? Damn right, he went for Shopify, like approx. 3-5% of Small Businesses selling online worldwide (according to our estimate, more details in the attached valuation mode). It is also the e-commerce building platform growing the fastest.

Why? Shopify Value Proposition

Shopify leads market share and growth for a reason: enhanced by its scale, a superior value proposition creates a value flywheel that widens its moat over its competitors.

When I started my own e-commerce venture in 2018, I had the option to start from scratch or buy an existing store. If you choose the first option, you will probably want to take an online course on how to build e-commerces or watch Youtube videos explaining it to you. I did, and half of the first 10 videos suggested by Youtube show you a step-by-step process on... Shopify. Finally, I decided to go for the option of buying existing e-commerce. There are a few marketplaces to buy that kind of business online, and there is even one owned by Shopify itself called "Exchange Marketplace". At that time, I thought, "wow, if I want an easy exit alternative, getting access to this marketplace is a good one". That's when I decided to buy a Shopify e-commerce, not just e-commerce. Then you have :

A polished UX with an easy, step-by-step, no-code, process to have an up and running best in class e-commerce

Hundred of thousands of website themes available.

Thousands of developer extensions, enabling the native integration with about everything you can think of, from Google & Meta advertising channels to syncing with third parties marketplaces like Amazon, Walmart and most local players (like Shopee or MercadoLibre). It has just announced a partnership with Youtube as the first platform to sync with YouTube Channel creators to sell their products on what seems to be Google's "social commerce" play [updated on Aug 22].

A smooth checkout experience with Shopify Payments

Higher conversion rates for high ticket items thanks to the offering of a buy now pay later option.

Native integration with shipping providers and faster deliveries with Shopify Fulfillment

Working capital financing with Shopify Capital

A new Checking account service with a debit card called Shopify Balance (I haven't tried it)

They make it easier to sell abroad with their Global-E partnership through Shopify Markets.

Exclusive access to a growing new sales channel called "SHOP", which is a Shopify-owned retail app growing pretty fast (it now has approx 18 million active users worldwide and is currently top 20 in the retail category for iPhone users)

It doesn't get any better than this as far as value proposition and moat are concerned. The more you grow your business and use these services, the harder it gets to churn. Shopify has massive network effects and switching costs. A hot, hot, potatoes then, but is it too hot to invest in?

Shopify Valuation Scenarios building

💡

You can download the spreadsheet template with the detailed DCF model used in this valuation

Forecasting the next 10 years of growth of Shopify

Shopify gets 29% of its revenue from subscriptions, which starts at 29 USD per month for the first tier and goes up to 2.000 USD for its enterprise solution. 2 million businesses from 175 countries pay this subscription as of December 2021, primarily small businesses. According to Statista's analysts (who combine Eurostat, ILO, OECD and Wordbank data), there were 212 million small businesses with less than 250 employees in 2020, and 28% of them sold through the Internet (Source: Euromonitor 2021). It means Shopify's share of the total addressable market is approx. 3.5%. I assumed the number of SMEs worldwide will grow at an average 2.5% annual rate until 2032 (it grew 2.8% in the past 20 years), and Euromonitor forecasts the percentage of it that will sell through the Internet will increase to 32%. This gets me to a total addressable market of 92 million SMEs in 10 years.

Estimated number of Small businesses in 2020 212,980,000 Last 20 years CAGR in small businesses 2.80% Next 10 years estimated CAGR 2.5% Number of Small Biz in 2032 286,434,422 Number of Biz selling through Internet in 2021 28% Number of Biz selling through Internet in 2032 32% Total potential Market in Merchants in 2032 91,659,015 Current number of merchants subscribed to Shopify 2,063,000 Merchant subscribed back in 2016 377,500 Subscribers CAGR L5Y 40% Current Shopify market share 3.5%

5 years ago, the average subscription price paid by Shopify´s merchants was $42 a month. Now it sits at $52, so it grew at a 5% average annual rate. In my bear case, I projected the average subscription price growth would slow a bit at 4%, while in the bull case, it would accelerate to 6%.

2032 projections BEAR Case BULL case Base Case (median) market share by 2032 4.00% 10% 7.00% number of merchants 3,666,361 9,165,901 6,416,131 Implied subscribers growth 5% 15% 11% avg subs fee next 10Y CAGR 4% 6% 5% avg subs fee by 2032 $83 $103 $93 Total Subs Anual Revenues (000) $3,672,512 $11,321,424 $7,496,968

The subscription business was its first business model, so the fact it gets 2/3 of its revenues from everything else means SHOP has a pretty good innovation and organic growth track record. Some of these ancillaries businesses are just starting, like the banking and buy now pay later for example. In 2021, the average ancillaries revenue Shopify got from its merchants was $132/month, up from $44 in 2016! It means it grew ancillary revenue by merchant at an impressive 24% annual rate.

2032 projections BEAR Case BULL case Base Case (median) avg ancillaries fee next 10Y CAGR 10% 18% 14% avg ancillaries fees by 2032 $377 $816 $596 Total Ancillaries Revenues (000) $16,578,291 $89,714,430 $53,146,360

My base case (median between the bull and bear cases) is that SHOP would sell $61 billion annually by 2032 to 6.5 million merchants. It implies growing subscribers by 11% annually (it grew 40% a year in the past 5) and average annual revenues per subs by 13% (it grew 17% in the past 5 years).

Forecasting Shopify margins

It means the tendency to get more income from its "enterprise" (bigger businesses) customers should intensify. It impacts the margins positively as the churn rate for these customers is much lower, and less gross margin is spent on acquiring new, smaller customers. 2021 operating margins sit at 16.5% (see the attached model for details on this calculation as I have capitalized research & development expenses). Still, analysts expect it to shrink to 2% in 2022 because of massive investments in their fulfillment centers and a change of policy with the third parties developers, who will now start paying commissions to Shopify from 1 million dollars in sales onward. The global software industry operating margins are approx. 20%, Amazon´s operating margin, the king of fulfillment centers, is just 10%. How much will Shopify venture into the last mile economy (it recently bought Deliverr to strengthen this approach) eat into margins, and for how long? I built a simple weighted average between the different lines of business based on their estimated revenue, using industry benchmarks as a guide, which gets me to a 13.2% target margin. That would be my bear case, given Shopify should do better than industry averages thanks to its pricing power. I end up with a 14% operating margin as my base case.

Business % of Revenues Avg Operating Margins Weighted Operating Margins Software (System & Application) 50.00% 19.82% 9.91% Financial Svcs. (Non-bank & Insurance) 20.00% 9.17% 1.83% Retail (Online) 30.00% 4.75% 1.43% Company 100.00% 13.17%

Forecasting Shopify returns on capital

Capital efficiency determines how much of the remaining operating income needs to be reinvested into the business to grow. This required reinvestment rate is then used to compute the return on invested capital (aka ROIC). I used the sales to capital ratio as a proxy to forecast the reinvestment rate. Shopify´s sales to capital in 2021 is 0.8, and Amazon´s is 1.6. I assumed the sales/capital to remain stable for the first 5 years, then converge toward a higher capital efficiency (1.5), thanks to the long-term investments Shopify is currently making on multiple fronts. It means Shopify has an average cost of capital of 8.8% and ROIC of 9%, peaking at 13% between years 7-9. I maintained a "cruise" ROIC of 11% in its "terminal year" because I believe Shopify moat is long-lasting.

The boring but essential stuff (aka Cost of Capital)

This is where assumptions are totally out of one´s control, as it is impossible to know where interest rates will be 5 or 10 years from now. I used a risk-free rate of 3.75% (today´s rate is 3.2% as I am writing this, but increasing each week), then fall back to 2% in the terminal year of the DCF model. It means I am punishing valuation by anticipating a long inflationary cycle.

💡

Are you enjoying this content? If yes, please support me to keep going, by reviewing us or subscribing for the price of a coffee (this one gets you exclusive access to our Slack workspace).

Is Shopify a good investment right now in 2002?

My base case consists of the average between my bear and bull case. It gets me to a Shopify fair price of $45 per share, which suggests it is 28% undervalued (update from Aug 27th) if you think my story makes sense. On top of that, SHOP scores 12.5 on the rookie scorecard, so for me, it´s a buy. What to watch in the subsequent earnings? The pace of merchants' subscription growth, the average price per subs, the average ancillaries revenues per merchant and the evolution of the operating margins in the next few years.

Disclaimer

The author of this post owns shares of SHOP. The Rookie Investor recommends SHOP. The Rookie Investor has a disclosure policy. This article by The Rookie Investor is not financial advice as it does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. eToro is a multi-asset platform that offers both investing in stocks and cryptoassets, as well as trading CFD assets. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Have feedback on this article? Concerned about the content? Get in touch with us directly.