🧯How to make money out of the supply chain mess?

Well before the Suez Canal was blocked by a ship, the global supply chain was already kind of a disaster.

Samsung was forced to idle two chip factories in Austin, Texas, in February. Honda and Toyota had halted production at plants in North America. Several of Dow´s petrochemical plants in Texas were forced to shut down during the freeze, and its CFO said they would be running at 80% capacity by the end of March. Worse, he estimated it would take more than six months to correct the supply-and-demand imbalances. It is hard to find one single industry not affected by this mess.

The extreme weather, trade tensions, cyberattacks, port backlogs from the pandemic-driven rise in consumer demand, covid related productivity pressures, and the latest Suez Canal issue are all converging to put a strain on worldwide supply chains. All of this creates cost and time delays for many industries, affecting profit margins and the prices that companies and consumers ultimately pay for many goods. Even if things normalize in the medium term, storms will become more frequent, and so will be more giant waves; both are a direct impact of climate change. Because of such waves, the Chilean port of San Antonio had 30% more exceptional closure events in 2020 than the year before. Indeed, it doesn´t take much to tilt the market, so global supply chain disruptions will probably become the norm. Not to mention the SolarWind hack scandal that proved that CyberSecurity risk is also growing from the supply chain.

A better connected supply chain and fulfillment centers

AI is enabling supply-chain companies to forecast demand and optimize supply chains in an increasingly dynamic business environment. AI is also helping companies better understand consumer buying habits and plan their supply chains more effectively.

Barcoding and RFID are being used to track and manage assets across the planet through the Internet of Things. Zebra Technologies (ZBRA), one of the leaders in this space, plays a central role in applying these technologies to new problems. Zebra is moving from selling printers and scanners toward analyzing and acting on data to provide value-added solutions. Its latest acquisitions, Cortexica Vision (machine vision and AI), Reflexis Systems (workforce management software), Profitect (retail analytics), and Temptime (remote temperature monitoring), help it deliver on its promise of "sense, analyze, act."

Zebra has been the leader in creating and reading barcodes for nearly 50 years. Its future is in using that information to understand logistics and workflows around objects. That leads to better ways of doing things around all of the supply chain.

Zebra scores 11.5 on my scorecard, which is good (I consider everything above 10 to be a buy), with its main fortitude being having a solid moat. The problem is it does seem overvalued by any method you can use.

More inventories in more places

Besides the surge of e-commerce, the warehouse real estate industry has another tailwind: the need for greater resiliency. The supply chain mess convinced businesses to keep more inventory on hand to avoid running out of key parts. Chris Caton, senior vice president of global strategy and analytics at Prologis (The biggest REIT with industrial warehousing real estate) says “that will be a defining characteristic of the industry over the coming years. More inventory, of course, means more demand for a place to put it."

On pick I love to take advantage of that megatrend is the self storage REIT named Life Storage(LSI). LSI has a product named "Warehouse Anywhere" dedicated to attract business customers. It offers innovative inventory management tracking technology to support customers' supply chain and last-mile delivery needs through data and tech.

I love the possibilities their "Warehouse Anywhere" platform model offers. Life Storage "only" has 900 storage facilities across the US, but they partner with another 10.000 third party storages that can be accessed and invoiced through Warehouse Anywhere. They also integrate with other third-party services such as couriers and charge a commission on it. In the near future, I can see WarehouseAnywhere transforming more and more toward a "platform as a service" where their customers could buy services such as insurances, couriers, labeling, printing, and more.

Life Storage scores 11 on my scorecard, with a good moat a great financial fortitude. On the valuation side, it is 25% higher than the last time I recommended it back in September, and now looks a bit expensive.

Manufacturer´s capacity building

If the pandemic and supply chain mess has shown one thing, you cannot over-rely on other countries to source critical products such as vaccines and microchips. No wonder why, besides the secular demand for electronics, Taiwan Semiconductor Manufacturing (NYSE: TSM), announced in January that it is planning a huge investment in new manufacturing capacity this year, with its capital expenditures forecast to be a breathtaking $25 billion to $28 billion.

There are some exciting pick and shovel plays in this industry, such as ASML and Lam, but my favorite pick to take advantage of manufacture upgrades is OLED. It turns out that the Samsung plant that shut down earlier manufactures chips for organic light-emitting diode (OLED) panels. Apple, which procures OLED panels from Samsung, could also face disruptions in iPhone production. All in all, every producer of electronics need to invest in improving their capacity and be less dependant of third parties, including for screens.

Universal Display (NASDAQ:OLED) is one of the leading manufacturers and license sellers for the Organic Light Emitting Diode used in TV and smartphone screens. OLEDs are not just thin and efficient; they can also be made flexible and transparent. To date, a majority of the OLED market has been targeted at mobiles and wearables. To dramatically expand the addressable “square acreage” for OLEDs, the industry will need to cost-effectively scale OLEDs for TVs (the average TV has 100x the area of substrate versus the average mobile display). Universal Display is, however, well-positioned to tackle this challenge. Recent advances in its organic vapor jet printing (OVJP) tech show promise and could aid in the commercialization of large-area OLEDs at greater efficiency.

I recommended OLED back in March, and even if it´s up 10%, I still think it is a good time to buy. It scores 15 on my scorecard, which makes it a super strong buy with strong moat, financials, culture, insiders buying, and it is "only" modestly overvalued.

Cut the middle man

One way to rethink supply chain resiliency is to minimize exposure to long transportation distances that make it vulnerable to extreme weather and geopolitical tensions. In the food supply industry, this means growing the food next to the consumer. It also happens to lower its carbon footprint. This solution is known as vertical farming. What is vertical farming? It is growing crops vertically with layered stacks in controlled environments that maximize yields while minimizing inputs. Vertical farms can be placed anywhere, including urban settings and distribution centers. That means produce can be grown close to consumers and lower the global food logistic's carbon footprint.

Investing in this early trend is not that easy though, and my favorite bet here is not a farm, nor a farm provider, but an e-grocery. In June 2019, Ocado (OCDO) acquired a majority (58%) stake in the Jones Food Company, a UK vertical farm, for £17m. The group has also entered into a three-way equal-weighted joint venture in Infinite Acres, in which it partnered with US vertical farming company 80 Acres and Dutch horticultural expert Priva. Since the grocery opportunity has become so much larger recently, Ocado is re-allocating resources from some of the options beyond grocery to focus on further developing the grocery platform. The company is generally looking at businesses where the IP it has developed can be of relevance. What kind of IP? Well, the kind that makes 6 other grocers, from Japan to the US, pay Ocado to help them set automated warehouses. Plus Ocado just bought two robotics firms. Its CEO expects to build vertical farms inside Ocado grocery facilities at some point. Robotically picked super fresh food. An attractive selling point.

Last but not least: smarter sourcing

The leader in this field is Coupa Software (COUP). Coupa's business management platform helps organizations manage business expenses and source inventory more efficiently. Its stock has increased 105% in the last year, but it still has plenty of growth potential left. Let me explain why.

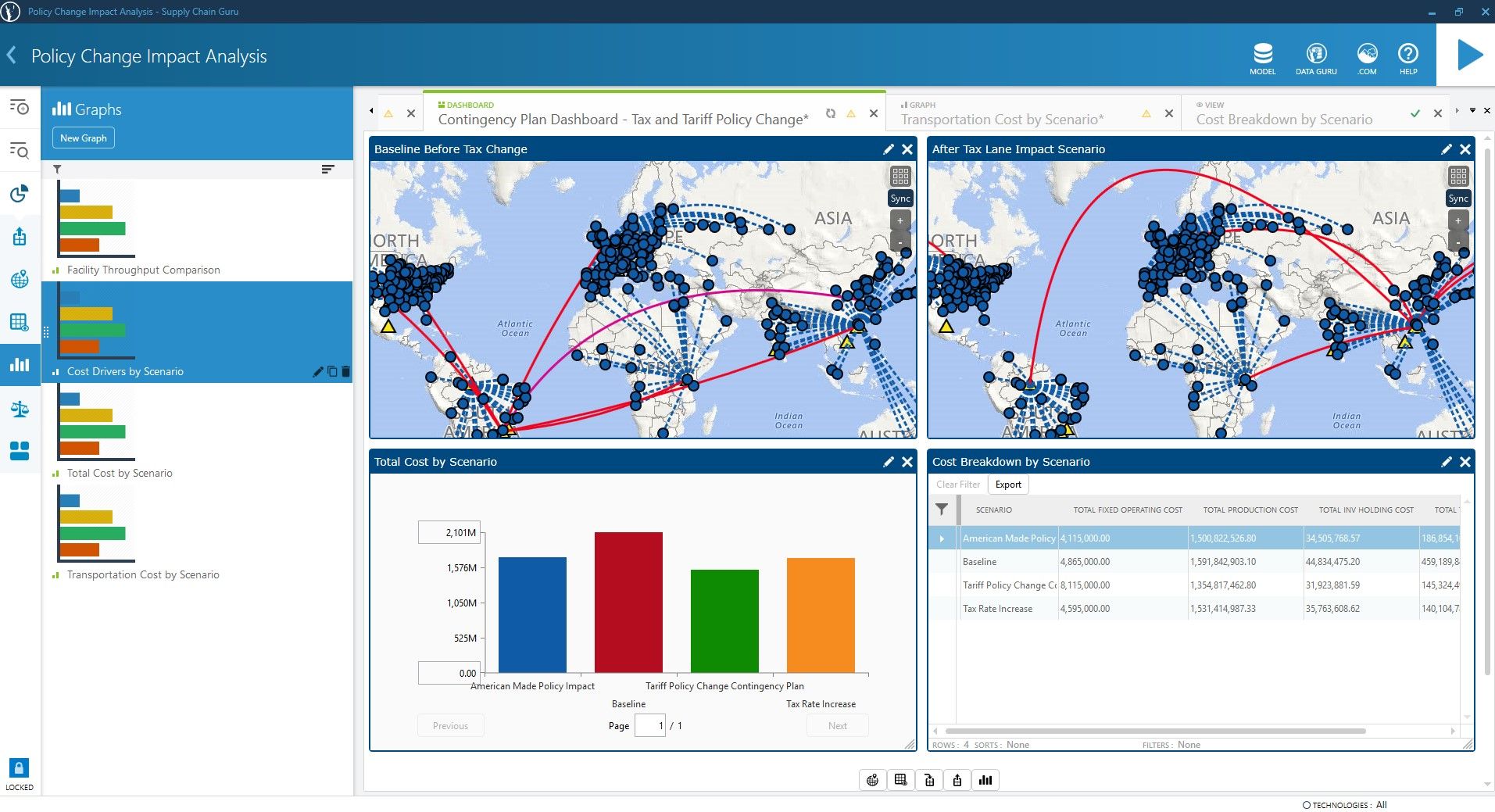

Their Coupa Sourcing Optimization (CSO) is a patented tool that uses combinatorial optimization to hold complex auctions between suppliers and buyers. The sheer number of possible combinations, such as price, quality, supply chain risk, would make it impossible to determine the winner. Did you say supply chain risk? Yes, I did. Over time, this cloud-native software company leveraged its deep expertise in expense and sourcing management to include supply chain planning and design into its product portfolio. It eventually bought Llamasoft in 2020, one of the leading supply chain modeling, optimization, and simulation software. They are now capable of leveraging Cybersecurity risks, ESG risks and Logistics risks into their algorithm. No doubt Coupa is the business partner needed for a messy supply chain future.

The synergies between Llamasoft and Coupa are apparent, as it connects planning and actual spending into one integrated solution. Here is how its CEO puts it:

"we think we've got just an incredible platform here to help companies not only design their supply chain for the longer-term and short-term but plan out what goods and services they're going to need to source. So that's an obvious synergy point, but the beauty is after we see that transactional spend happening, as you start buying these products, we're picking up a whole host of community data that's highly relevant. And we're looking to use some of that information to inform how to design and plan next time around more optimally." Coupa´s CEO in its last earning call

Besides their multiple patents, CSO benefits from the network effect of more suppliers and buyers joining. Today, there are more than 7 Million suppliers plus 2000 buyers using it, and $2.3 trillion of cumulative spend under management, that a lot of data to work with. This should help keep Coupa ahead of its rivals for some time and maintain its 30+% growth.

Coupa scores 14.5 on my scorecard. Its main fortitude is having a solid moat and positive signals from the Smart money: hedge funds have increased positions in the last quarter, a director bought shares, plus analysts are bullish about its next 12 months target. Its current valuation looks pretty high on a price to sales ratio, but not that much based on a future-oriented cash flow model (DCF). In fact I am adding to my COUP position as I am writing this.

Happy investing!

You can see my live portfolio, my stats, or even copy my trades, on eToro, which is the broker I use. In case you do open an account with eToro, use this referral link, let me know and win 100 USD cash.

If you like my content you can subscribe for free and follow me on Twitter.

The author of this post owns shares of Universal Display Corporation, Zebra Technologies, Coupa Software, Ocado and Life Storage. The Rookie Investor recommends these stocks. The Rookie Investor has a disclosure policy.