Keep an eye out when insiders buy their company's stocks. Based on last year´s data, I learned this.

What is insider buying?

Insiders are officers, board members and 10%+ owners of a company. These people must report any buying or selling of the company shares to the SEC, making it public through its website. The form used by the SEC is called "form 4," and it looks like this.

"Insider trading" is usually referred to for illegal activities, buying or selling based on information not available to the general public. I will not focus on this kind of activity here, as insider buying and selling is not illegal if it complies with the SEC rules, but whether you comply or not, being an insider almost always gives you an information edge. And information is power thanks to information asymmetry (like when you buy a car).

Is insider buying worth watching?

Keeping an eye out when insiders buy their company's stocks is a great way to get stock ideas. It's something that can help you out when you're making decisions on what stock to invest in or if you're simply considering buying a stock. When an insider buys their company's stock, it's usually a good sign for the company. It means that they believe in their company and that their company is moving in the right direction. Remember that insider buying isn't for everyone, though, and should complement a deeper analysis of the company fundamentals and valuation. An insider worth a billion dollars who invests 10 million in a company is betting just 1% of its portfolio... Usually, there are industries where insider buying signals are more relevant, such as in Biotech, because of the importance of rumors regarding FDA approvals.

What about Insider selling?

"There are many reasons to sell, but just one to buy" old saying sums it up. I would not lose any minute of analyzing selling patterns. The only relevant signal I watch is buying. Some news outlets love the headlines like "Insiders are selling their stock at a record pace" to fuel the panic, don't even read it. The track record of insiders beating the market when selling is mixed, but much better when buying.

How can you spot insider buying? Insider Trading Cheat Sheet.

How to find insider transaction information for the US Stock market

The SEC maintains the website EDGAR, which contains reports of such transactions and has a searchable database of insider trading reports from 1982 to the present. Now, like almost any government website, the UX sucks, and you better use an information aggregator instead. I find Finviz to be the easiest, and it is free. Be careful as there are 3 kinds of buyings, but only one is relevant to track.

- Stocks granted as options: not relevant. This one is easy to spot as Finviz helps you filter it out as "Option Exercise"

- Stocks bought under a Rule 10b5-1 trading plan: not the most relevant but still a positive signal. Rule 10b5-1 allows company insiders to set up a predetermined plan to sell company stocks. The price, amount, and sales dates must be specified in advance and determined by a formula or metrics. It is a way for insiders to be shielded against illegal insider trading allegations. It's harder to spot it as you will have to read the Form 4 footer notes to see if it is the case, like the ASANA CEO's case.

- Stock bought at market price without a trading plan: my favorites. I recommend ignoring buys for less than $10k, as you could see some automatic tradings, such as this one, who "automatically reinvest dividends" according to the form footer notes.

I used to look for a way for me to receive automatic alerts when an insider bought shares of a company I was watching. Pretty simple stuff, huh? Well, believe it or not, I did not find any service, not even paid, that made this simple task without spamming me for hundreds of insiders trades. So I built my own program, which does just that. The filtered alerts are sent on Slack once a day (yes, I know, Slack is almost "old school" but I am not a fan of Discord, too spammy). You can join my Slack to receive it, or follow me on Twitter or Instagram as I post some of the most relevant alerts there.

How to find insider transaction information for the European Stock market

Although insider trading is illegal in the US, it is not the same in the European market. There are no specific rules and regulations for insider trading in Europe, leaving the door open for big financial rewards. Because insider trading is not illegal, it is not tracked by any official agency in the European market. However, it is up to the investors to stay informed on any insider trading information.

The rules are different in every country. In Britain, for example, there is a register of insider transactions which is maintained by the London Stock Exchange, but not easy to find. In fact, the easiest way to look at this information is through Yahoo Finance here. However, there are certain exceptions. For example, the register does not include transactions made by insiders before they became insiders. Also, the register does not include transactions made by companies before they became listed.

All in all, finding Insider activity outside the US market is a pain, but there are paying services that does it for you, such as InsiderScreener.com (9 USD /month).

Insider buying signals in real life / Insider Buy Signals That Could Make You a Lot of Money.

What happened in the past 12 months with insiders buying?

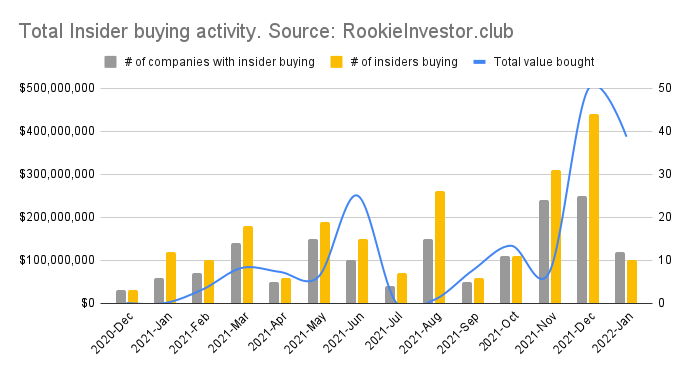

As you can see in the graph below, Insiders buying reached record numbers in December 2021 (for the period starting in December 2020), right after many growth stocks started getting hammered, like the likes of DOCU, VUZI, TWTR, AXON, S, PYPL and more. Terrible timing! The NASDAQ saw a -14% correction the month after that. This is an excellent lesson: insiders buy based on company prospects. They are not market predictors. This is why following insiders is more relevant for the long-term game. Still, many insiders saw their company stock as a good bargain back in December. It should be even more after the market correction. Indeed, we saw massive amounts bought during January, albeit by fewer insiders (the less afraid ones!) We are still in the middle of a highly volatile market. I guess some insiders are waiting for some calm before pilling in again.

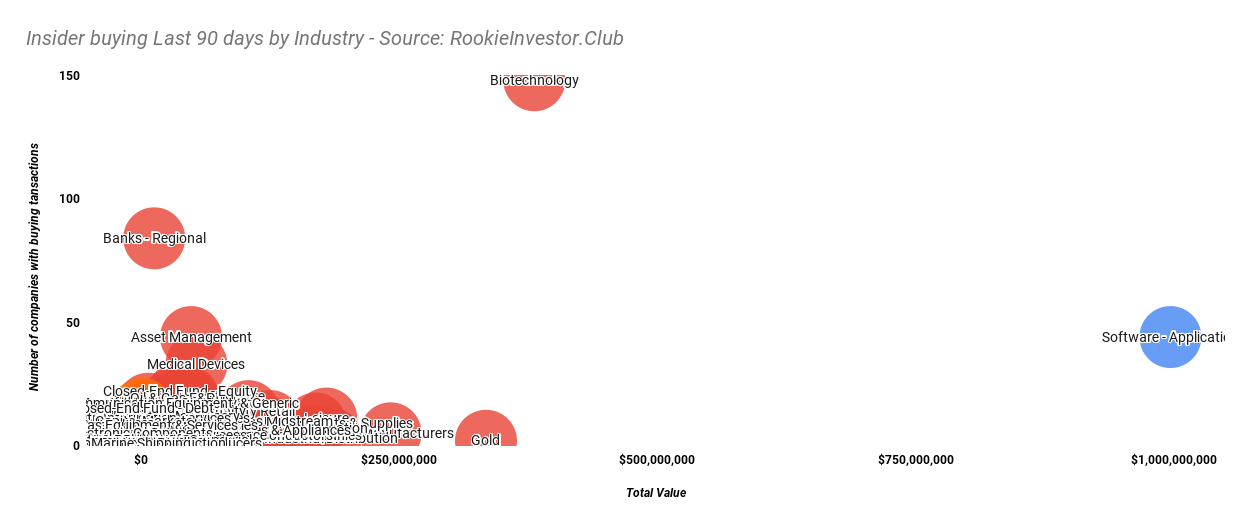

Biotech, the outlier

Let's break down insider buying from the last 90 days by industry, and you will see why Biotech is an outlier. Biotech is almost always an outlier, regardless of market conditions (I assume that the highly sensitive nature of FDA approvals and clinical trials results rumors give insiders a true edge). All the Biotech related trades I have made inspired by insiders turned out to be profitable. There was the gene-editing company EDITAS (EDIT), with 2 different insiders buying back in March, to jump more than 40% 5 months later after reporting a couple of good news regarding clinical trials during its earnings. Then there was Vertex Pharma (VRTX), 2 insiders shaw me the light back in August. Five months later, again, the stock is more than 20% up after giving bullish guidance during its earnings, a remarkable feat knowing the rest of the market is in correction territory.

Of course, these are just 2 trades, It can't go the right way always, and it can fall rapidly afterward like EDIT did, so you need to know when to push the "sell button". I would advise against buying biotechs you know nothing about in any case. This is why I have not bought any lately.

Software, the time to invest is now.

Yes, the other outlier on the upper chart is the Software industry, where many of the growth stocks were crushed in the past 3 months. No wonder why Insiders got interested. Here are the top movements by ticker. Remember that ASANA (ASAN)'s huge number is based on a scheduled trading plan of his CEO.

| Ticker | SUM of Value ($) |

|---|---|

| ASAN | $673,995,791 |

| GTLB | $150,001,406 |

| DUOL | $58,586,811 |

| XM | $32,774,376 |

| CWAN | $21,393,599 |

| GTYH | $13,755,310 |

| SMAR | $9,563,843 |

| UBER | $8,984,540 |

| YOU | $8,265,962 |

| DOCU | $2,562,260 |

| SPT | $2,181,780 |

| NOW | $1,987,198 |

I did not analyze all of these tickers, only ASAN, DOCU and NOW. In my view, both DOCU and NOW are in a lovely spot in terms of fundamentals and valuation. I have made a detailed analysis of DOCU here and a more concise one on NOW here. I also added a few stocks from this list to my watchlist to get to know them better.

I can't say the market hit bottom yet, and Software stocks may still have a hard time in the next few months, but if you take the long view, as many insiders do, now is a marvelous time to get a few shares of some of the best software companies out there. You can check my stock scores database to help you flag potential problems in terms of fundamentals. It's free!

That's it, folks, stay fresh, stay rookie and happy investing.

Discuss on Twitter

Keep an eye out when insiders buy their company's stocks. Based on last year´s data, I learned this. https://t.co/Bg3Hq5P9D2

— The Rookie Investor (@henri_net) January 31, 2022